Earning donations requires market research, donor cultivation, and investment in robust donation management software. Fortunately, there is a way to double some of the donations your nonprofit has already earned.

Matching gifts are a fundraising method in which companies match their employees’ donations, usually at a 1:1 ratio. However, if your nonprofit is unaware of this fundraising opportunity, you are not alone. Double the Donation’s fundraising statistics report shares that 78% of eligible donors are unaware of whether their company offers a matching gift program.

When it comes to improving matching gift education, the first place to start is your nonprofit’s staff. This guide will walk through the matching gift process from start to finish to help your organization understand and take advantage of this fundraising opportunity.

What are Matching Gifts?

Matching gifts are a unique type of grant funding for nonprofit organizations. Rather than applying to specific corporations for grants, individual donors request the release of allocated funds when they donate to charitable organizations. This means to access matching gift funds, the only thing your nonprofit needs to do is alert donors and encourage them to pursue this fundraising opportunity.

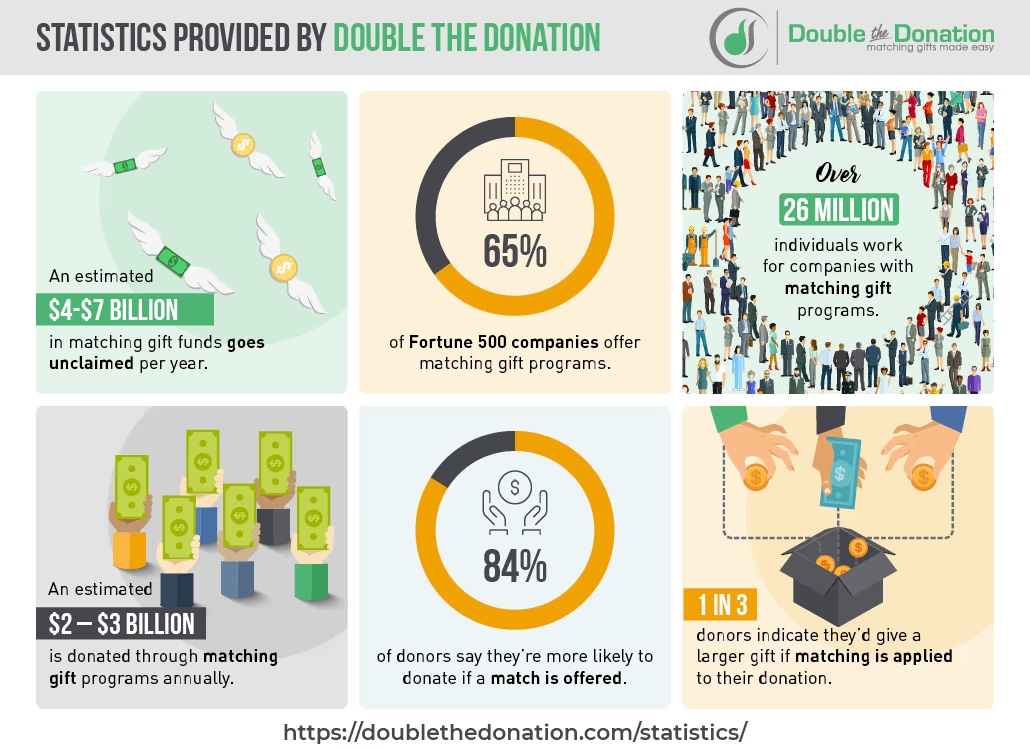

A wide range of companies offer matching gift programs, from Fortune 500 corporations to small, locally owned businesses. To understand how widespread matching gifts are, re:Charity’s matching gifts guide provides some useful statistics:

- An estimated $4-7 billion in matching gift funds goes unclaimed per year.

- 65% of Fortune 500 companies offer matching gift programs.

- Over 26 million individuals work for companies with matching gift programs.

- An estimated $2-3 billion is donated through matching gift programs annually.

- 84% of donors say they’re more likely to donate if a match is offered.

- 1 in 3 donors indicate they would give a larger gift if matching is applied to their donation.

In summary, matching gifts are a popular corporate giving program that encourages donors to give bigger gifts more often. To learn how to better promote this giving method, let’s walk through the matching gift process.

The Matching Gift Process

Initial Donation

Matching gifts begin with a regular donation. However, you can still optimize this part of the process for matching gifts by investing in dedicated software.

Matching gift software provides nonprofits with access to a matching gift database that contains information on corporate giving programs and a search tool they can embed into their website. By embedding a matching gift search tool into your nonprofit’s donation page, donors will be prompted to check their matching gift eligibility and start their matching gift journey while donating.

Additionally, matching gift software can pair donors with their employers’ matching gift information if the donor provides their work email address when giving. If your nonprofit uses a CRM that integrates with matching gift software, like CRMs from Blackbaud and Salesforce, it can automatically identify donors who are match-eligible.

As such, nonprofits serious about earning revenue through matching gifts should assess their software and find a matching gift vendor whose tools integrate with their current technology.

Eligibility Check

Each business has unique rules for its corporate giving programs, and matching gift programs are no exception. To confirm their eligibility, donors can use your nonprofit’s matching gift software or check directly with their employer.

Whether a donation is eligible for a match usually depends on the following factors:

- Employee status. Full-time, part-time, and retired employees may all be eligible for matching gifts. Some employers even extend eligibility to their employees’ spouses, whereas others have additional limits, such as requiring a certain length of employment before gifts will be matched.

- Gift amount. Most businesses have minimum and maximum donation amounts for employee gifts. Minimums encourage higher donations and prevent businesses from being flooded with requests to match small-dollar gifts. Maximums cap how much the business will spend on matching a single employee’s donations each year, helping balance these programs’ budgets.

- Nonprofit type. Businesses usually limit what types of nonprofits they will match gifts for. These can be highly selective, such as only matching gifts to educational institutions. Usually, these programs are flexible and only exclude religious organizations, political organizations, and nonprofits owned by the employee or the employee’s family.

- Match request deadline. To ensure matching gift requests are submitted in a timely manner, most businesses have deadlines for when employees must complete matching gift applications after donating. This deadline is usually the end of the year, though some organizations have grace periods to account for the year-end giving rush.

Your nonprofit cannot accommodate and provide direction for every business’s unique guidelines. Instead, optimize your online platforms for matching gifts by creating a matching gifts page on your website or adding matching gifts as a section on your “Ways to Give” or equivalent page. Explain how program requirements vary, encourage supporters to check their eligibility, and embed your matching gift database search tool if you use matching gift software.

Employer Match Request Form

Once a supporter confirms their matching gift eligibility, they can complete a matching gift request form. Matching gift software can connect donors with these forms and auto-submission tools can even complete their forms for them.

If a nonprofit does not have matching gift software or a form cannot be accessed, donors can usually find their employer’s matching gift application through their CSR software portal. Employees will need to log in, navigate to the matching gift form, and fill it out with information about their gift and your nonprofit.

Usually, these forms are straightforward and ask for basic information, such as the donation amount, payment method, and date given. In regards to your nonprofit, they may ask for your EIN, contact information, and a brief description of your mission.

Confirmation

Once the application form is complete, businesses will review it and determine whether to approve the match. In some cases, businesses may reach out to your nonprofit to confirm information or ask for additional documentation, such as the donation receipt.

If the application is approved, your nonprofit will either receive a payment from the business or their CSR vendor, depending on how they manage their matching gift program. These payments may come soon after a matching gift request is submitted, or you might receive batches of payments on a quarterly basis due to businesses saving and reviewing multiple applications at once.

The matching gift process is complete after you receive a payment. The only necessary follow-up is to thank the donor who submitted the matching gift request for going the extra mile for your nonprofit.

Matching gifts are an underused fundraising method that can bring nonprofits additional revenue. To get the matching gift process started, consider investing in matching gift software, use your CRM to identify match-eligible donors, and start promoting matching gifts to supporters to ensure they’re aware of this easy fundraising opportunity.